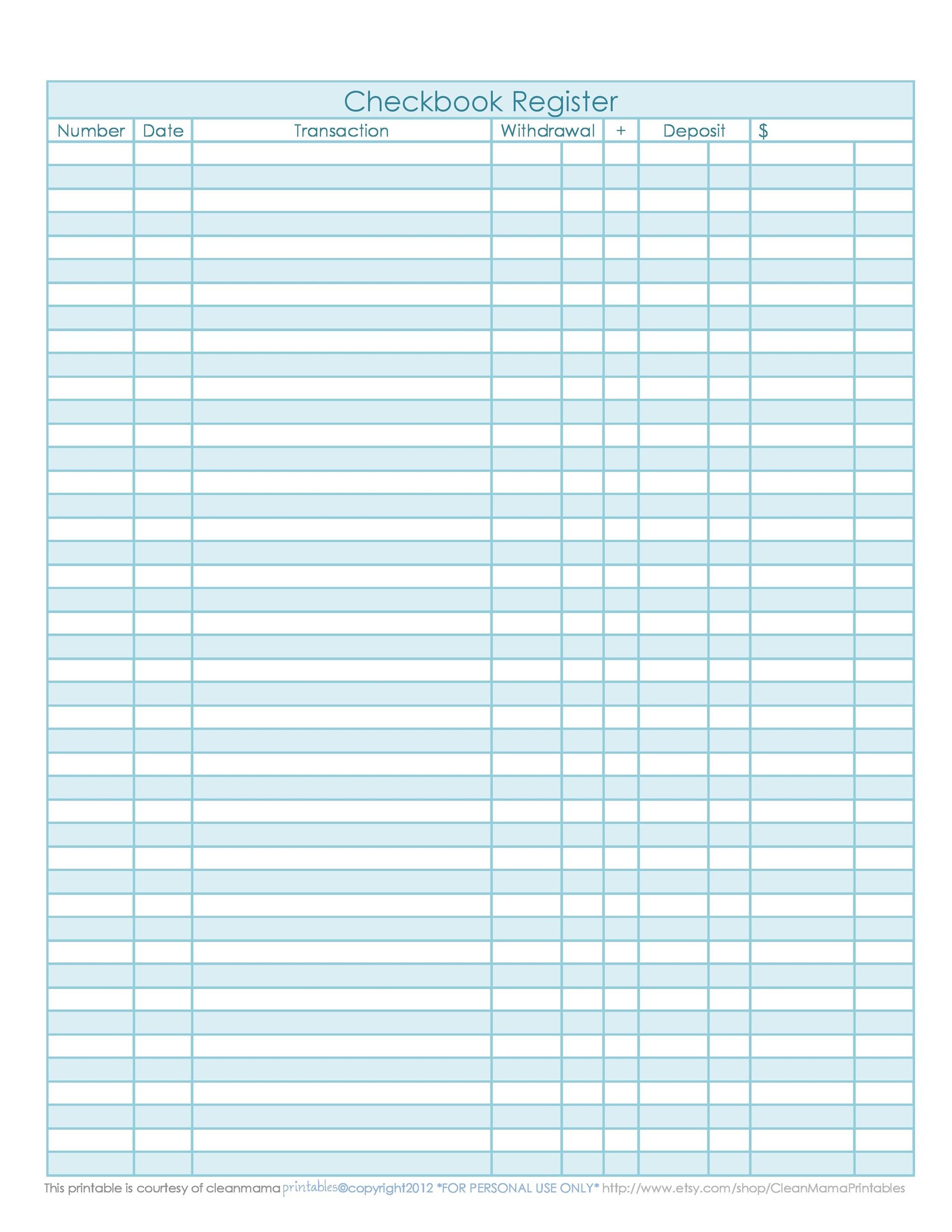

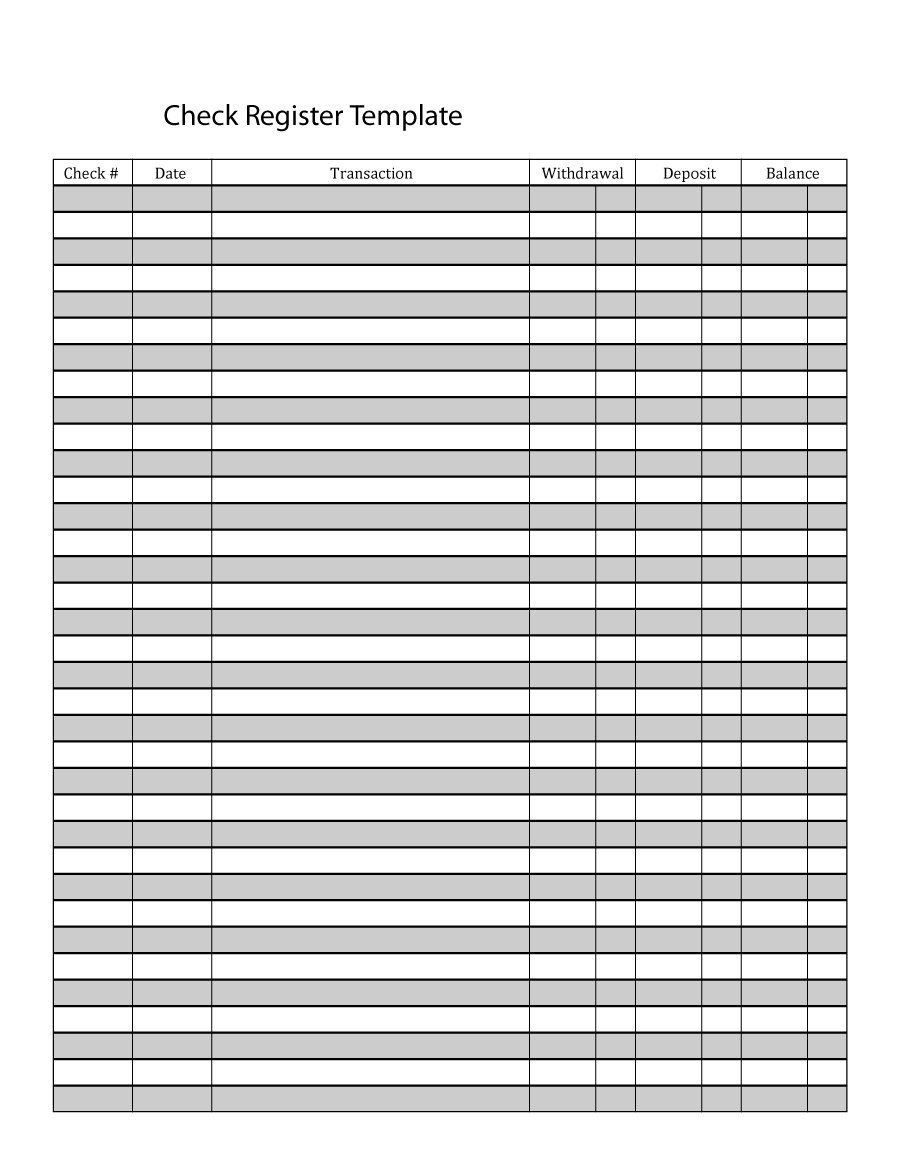

You can evaluate your financial inflows and outflows using a check register. You can accurately track your spending patterns, spot any discrepancies, and reconcile your account with bank statements by meticulously keeping track of every transaction. Your financial activities are fully documented in a check register. How is Check Register Used for Financial Evaluation? This acts as a guide or digital record-keeping system where you can document all monetary dealings, encompassing drafted checks, added deposits, ATM retrievals, online transfers, and debit card operations.Ī common bank register consists of fields to record the date, the portrayal of the transaction, the check number (if relevant), the sum of the deposit or withdrawal, as well as the current balance.

What is included in check register tracking?Ī check register is an uncomplicated, yet effective method of monitoring and documenting transactions associated with your checking account. Understanding the function and advantages of a check register will help you achieve better control over your financial activities, whether you prefer the simplicity of pen and paper or use computerized techniques. A check register is still a useful tool for keeping track of and managing personal funds. It's simple to ignore the significance of keeping a check register in the current digital era, where mobile apps and Internet banking have become the norm. What is The Purpose of the Check Register?

0 kommentar(er)

0 kommentar(er)